Planning for the Future: Estate Planning for Young Families

Planning for the Future: Estate Planning for Young Families

Traditionally associated with older people or wealthy families, estate planning may seem like something not for young families. However, it is an essential financial strategy that every young family should consider. Early planning can provide financial independence and security for your loved ones, ensuring that your assets and possessions are distributed according to your wishes after death.

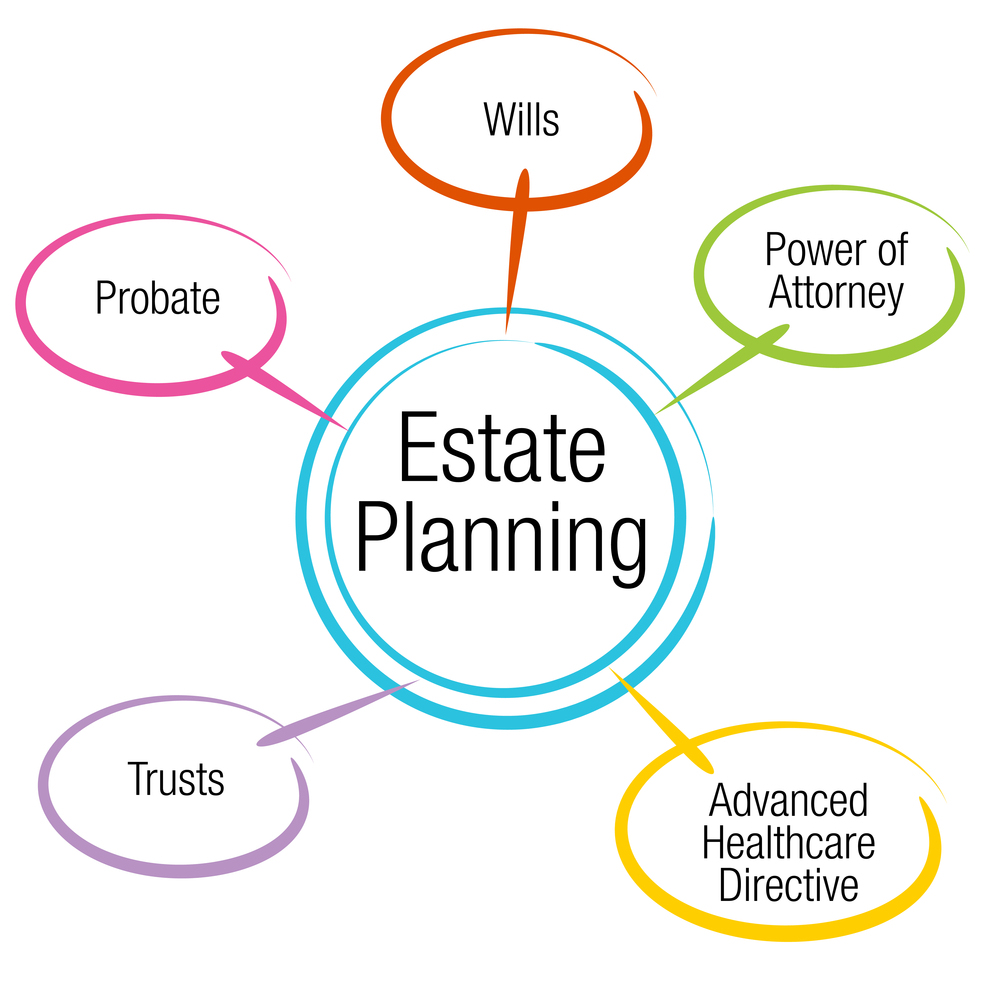

Many young families put off estate planning because they believe they don’t have enough assets to warrant a plan or because it’s uncomfortable to think about mortality. Nevertheless, it is critical to understand that estate planning isn’t solely about asset distribution. Here are reasons why young families must consider estate planning beyond only having a will.

Guardianship of children

One of the first steps in estate planning for young families involves choosing a guardian for minor children. If both parents were to pass away, a guardian would take responsibility for raising the children. Without a designated guardian, the court can decide who can raise your children, which might not align with your wishes. Therefore, discussing and documenting your choice of guardian is an essential aspect of estate planning.

A trust for your children

Next, consider establishing a trust for your children. A trust can ensure your children’s financial needs are met if you can no longer provide for them. The trust distributes assets according to your wishes, at ages, and under the specified conditions. For instance, you may want your children to receive a portion of their inheritance when they reach certain milestones, such as college or marriage.

The benefit of establishing a trust is twofold: it prevents children from mismanaging large sums of money if they should inherit at a young age and provides some level of preservation against creditors or future legal judgments.

Life insurance

Another crucial element of estate planning for young families is life insurance. Life insurance can replace income and cover any outstanding debts in the event of premature death, ensuring that your family is financially secure. The type and amount of life insurance you need can depend on your circumstances, including your income, number of dependents, and outstanding debts.

Legal documents

A comprehensive estate plan should include a durable power of attorney, healthcare proxy, and advanced directives.

- A durable power of attorney– A durable power of attorney allows someone to make financial decisions on your behalf if you are unable to.

- Healthcare proxy- A healthcare proxy operates similarly, appointing someone to make medical decisions if you become incapacitated.

- Advance directive– An advance directive allows you to specify your wishes regarding end-of-life care. This document can spare your family the anguish of making difficult decisions during grief and ensure your personal beliefs and preferences are respected.

Estate planning may seem daunting, especially for young families juggling numerous other responsibilities. However, consulting with financial, insurance, legal, and tax professionals can help simplify the process. And help ensure it aligns with your family’s objectives and needs.

Remember, estate planning isn’t something to be deferred until old age or until you have amassed significant wealth. It’s a dynamic process that must mirror your changing family structure, assets, and goals. By prioritizing estate planning early in your family’s journey, you can provide security, financial independence, and an independent foundation for your loved ones.

SWG3674379-0724d. This information is provided as general information and is not intended to be specific financial guidance. Before you make any decisions regarding your personal financial situation, you should consult a financial or tax professional to discuss your individual circumstances and objectives. The sources used to prepare this material are believed to be true, accurate and reliable, but are not guaranteed.

In addition, Lake Financial Solutions specializes in providing strategies and guidance for those who are seeking a better lifestyle in retirement. As a result, we offer our experience and knowledge to help you design a custom strategy for financial independence. Contact us today to schedule an introductory meeting! We look forward to working with you.